The surge to No. 1

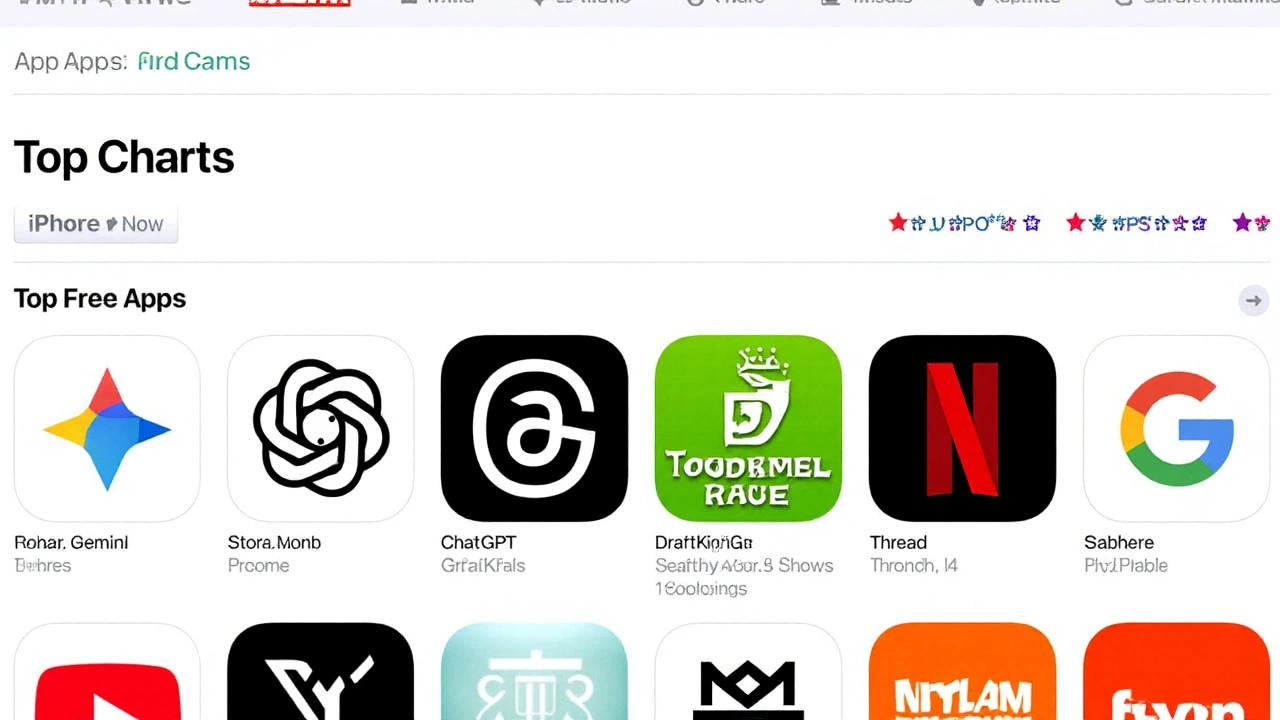

The most downloaded free iPhone app in the United States right now isn’t a social network or a new game. It’s an AI editor. Google’s Gemini shot to No. 1 on Apple’s App Store, slipping past OpenAI’s ChatGPT and pushing Threads into third. It’s a symbolic flip in a battle that’s been building all year: who owns the AI moment on mobile?

The timing is clear. By Friday evening in September 2025, Gemini claimed the top spot in the free chart. The rise wasn’t gradual—it was a sprint powered by a single feature that spread through group chats and camera rolls: a viral image model called “Nano Banana.”

Since launching on August 26, the Gemini app has racked up 23 million new users through September 9. Over that same window, Nano Banana handled more than 500 million image edits. Those aren’t vanity metrics. They map directly to what people actually do on phones: take photos, tweak them, and share them.

Google’s footprint across the App Store underscores the momentum. Beyond the Gemini app at No. 1, Google Search sits at No. 6, Maps at No. 8, Chrome at No. 13, and Gmail at No. 21. In the U.S., Gemini leads; in Canada and the U.K., it’s runner-up. The story isn’t just a rankings shuffle. It’s a signal that the center of gravity for AI on mobile is shifting toward multimodal tools that blend text with visuals—and often let visuals lead.

What changed? OpenAI’s ChatGPT essentially taught millions to chat with AI. Gemini is teaching them to make something with it—fast, fun, and good enough to share.

Why images beat chat on phones

“Nano Banana” sounds like a joke. It isn’t. Built on Google’s Gemini 2.5 Flash tech, the model leans hard into speed and style, not just raw IQ. Upload a handful of photos, pick a vibe, and the app turns your subject into a toy-like 3D figurine, splices them into storybook scenes, or remixes a boring snapshot into something you’d actually post. It keeps faces and features surprisingly consistent across edits, so the character in one frame looks like the same person in the next.

That consistency is the sticky part. People aren’t just generating one-off images; they’re creating a character—themselves, a partner, a pet—and carrying it across scenes. Think: a wedding party reimagined as a claymation set, a dog starring in a comic mini-series, a fitness progress collage turned into collectible cards. Without the usual prompt engineering, the app gets the likeness close enough. You talk to it the way you talk to a human editor—“make this moody,” “add neon lights,” “keep the freckles”—and it iterates in seconds.

Under the hood, Gemini 2.5 Flash is a lighter, faster sibling in Google’s model lineup, tuned for quick responses and image-heavy tasks. It’s not a research model trying to write dissertations; it’s a production model designed to churn out results that look polished on a phone screen and load quickly on spotty networks. That balance—speed, consistency, shareability—is why it spread.

Google also made a deliberate trade. The company limits free users to just five chat prompts a day, nudging the app away from pure conversation. But it offers 100 free daily image generations—orders of magnitude more. For paying subscribers at $19.99 a month and up, the cap on images jumps to 1,000 per day. In plain language: Google sees where demand is and is fueling it. David Sharon, who leads multimodal generation for Gemini Apps, put it simply in internal briefings and public comments—people are here to make images, so that’s what the product emphasizes.

On mobile, that strategy fits the medium. Text chat with AI is useful, but it isn’t inherently social. Images are. When a tool spits out something your friends want to ask about, that’s free distribution. Short-form video creators lay out “before and after” edits; group chats trade remixes; family threads turn into galleries. The product markets itself.

The ease matters, too. Early AI image tools often asked users to learn prompts, seed values, and sampler settings. Gemini’s flow is conversational. You upload photos, describe a look, and the model figures out the rest. The learning curve is almost flat, which widens the funnel beyond hobbyists and into the everyday camera roll.

All of that helps explain the adoption spike, but the App Store chart has its own mechanics. Apple doesn’t publish a complete formula, yet developers know velocity—how fast installs stack up—carries real weight. A viral week can move an app dozens of spots. Pair that with Google’s existing app footprint and cross-promotion, and the surge becomes easier to sustain.

What about ChatGPT? OpenAI’s app introduced the mainstream to AI assistants and remains deeply capable. It can converse, reason, and even handle images and voice. But the mobile experience still leans text-first. On phones, a single frictionless visual feature can overshadow a generalist assistant, at least in the charts. Gemini’s 100 free daily image generations also make it feel generous compared with five free chat prompts—a simple behavioral nudge that turns into daily habit.

For creators and small businesses, the use cases pile up fast. A restaurant can turn a handful of dish photos into a stylized menu reel in minutes. A realtor can transform room shots into consistent mood boards for staging ideas. A kids’ sports league can churn out team posters with the same character style across players. None of these require a prompt wizard; the interface and presets carry the heavy lift.

There’s a cost story behind the scenes. Image generation isn’t “free” for platforms. Compute is expensive, and the economics depend on model size, hardware, and how long each generation takes. A streamlined model like Gemini 2.5 Flash likely lowers per-image costs enough that 100 daily freebies make sense as a growth lever, while a tighter chat limit caps longer, pricier reasoning sessions. It’s a product decision that doubles as a margin safeguard.

Retention is the next test. Viral growth can fade if the output gets repetitive or if novelty wears off. Google will need to keep the styles fresh, improve likeness controls, and add guardrails that don’t feel like roadblocks. The company’s broader presence in the charts—Search, Maps, Chrome, Gmail—gives it owned channels to surface updates and re-engage users, a distribution advantage most AI startups don’t have.

Safety and authenticity loom over all of this. Synthetic images can mislead. The industry has been experimenting with watermarks and provenance metadata, and Google has been vocal about detection and labeling across its ecosystem. Still, questions remain about how consistently consumer-facing apps flag AI outputs once they’re saved, shared, and re-uploaded. The more photoreal the output, the more the pressure mounts for clear, durable labeling that survives screenshots and compressions.

Privacy is another pressure point. Gemini’s most engaging flow encourages people to upload multiple photos of themselves and friends. That raises fair questions: how long are those photos stored, are they used to train future models, can users opt out, and what happens if they delete their account? Clear settings, visible toggles, and plain-language explanations matter as this scales beyond early adopters.

The competitive field is only getting busier. Meta is weaving generative features into Instagram and Threads. Snapchat and TikTok keep experimenting with camera-native effects that ride the same shareable wave. Apple is rolling more on‑device AI into iOS over time, which could enable faster, private transformations right on the phone. For now, though, Gemini’s formula—cloud speed, low-friction editing, and a free tier built around images—has cracked the App Store code.

The regional picture hints at where it goes next. Gemini leads the U.S. charts; Canada and the U.K. show it in second. Localization, culture-specific styles, and country-by-country ad rules will shape expansion. The template is portable, but the tastes aren’t identical. What plays as “cute toy figurine” in one market might skew “artful comic panel” in another.

Developers are watching for technical breadcrumbs. The model’s knack for maintaining character likeness suggests better identity embeddings, smarter pose transfer, or both. If Google exposes more of that through APIs or creative tools, expect a wave of third-party apps to adopt similar “build once, reuse everywhere” character pipelines. That could standardize everything from brand mascots to influencer avatars across campaigns.

Policy makers are watching, too. The easier it gets to generate lifelike edits, the more important it is to provide friction around sensitive content—public figures, medical imagery, minors. Apps that scale to tens of millions quickly inherit newsroom-grade responsibilities: clear rules, fast takedowns, and human review for edge cases. Growth sharpens those obligations.

On the business side, conversion will be the scoreboard. A 100-images-per-day free tier is generous; the $19.99-and-up subscription has to justify itself with higher caps, priority processing, and premium styles or collaboration features. Expect enterprise add-ons next—brand-safe style packs, audit logs, and shared asset libraries—if the consumer curve holds.

There’s also a hardware angle. As chipmakers squeeze more AI acceleration into mobile devices, expect a split model: instant, privacy-friendly on-device edits for common tasks and cloud runs for heavier generations. That hybrid could trim latency, reduce costs, and make editing feel as native as a filter—without the wait spinner.

If you’re wondering how this changes your daily phone use, it’s already happening. Camera rolls are becoming raw material, not archives. Holiday cards, resumes, product mockups, class posters—things that once needed a designer—are doable in a lunch break. The gap between idea and output is shrinking, which is exactly where mass-market software breaks out.

What to watch next:

- Retention: Do daily active users hold after the Nano Banana buzz settles?

- Subscriptions: What percentage of heavy editors convert at $19.99+ a month?

- Safety and labeling: How clearly are AI images marked once saved and shared off-platform?

- Regional expansion: Does the U.S. playbook translate one-to-one in Europe and Asia?

- Creator ecosystem: Will Google open more style and character controls to third-party tools?

For now, the scoreboard reads like this: Gemini at No. 1, ChatGPT at No. 2, Threads at No. 3. The headline is rankings, but the real story is behavior. On phones, pictures beat paragraphs—especially when the pictures are new, fast, and feel made just for you.